As an example of the TSM approach, consider the following trade as described in the TSM Daily

Before-the-Bell Report on 5/19/05.

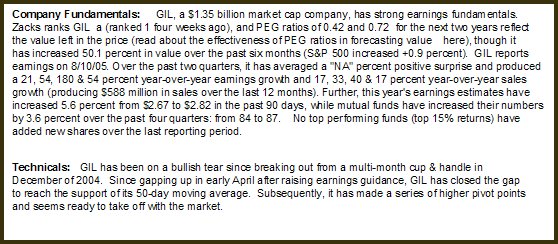

Obviously, GIL is a mid-cap company with quality

fundamentals, an improving Industry Group, good

earnings-revision fuel (Zacks 1 ranking), and much value left at

present prices (two-year PEG ratios less than 1.0). Though to

this point GIL had seen price growth of 50.1% over the past six

months, earnings were still growing, and value remained.

Not shown here is GIL’s daily

chart with explicit trade-management instructions, which is

routinely included with each TSM selection.

Technically, GIL had just experienced a 5-day pullback, the

first after a major period of consolidation followed by a

bullish run in the past month. GIL looked as if it were ready

to resume its longer-term bullish run. The following chart

documents the trade evolution.

The local

minimum (area “A”) offers support (technical stop-loss point)

for a trade reversal after entry on May 19th at the

first arrow. As shown in the “entry” box, the trade was entered

when that day’s price exceeded the prior day’s high (a

demonstration that bulls were in control). A few days later on

the 23rd half the position was sold for a $0.80/share

profit (+3.5%). Profit taking here combined with a resetting of

the stop-loss point ensures that this profitable trade doesn’t

turn negative.

As GIL’s

price continued to run up, a 2-day trailing-stop (sell stop

placed near the low of the preceding two days) strategy was

utilized as price climbed into an area of consolidation marked

“B.” Price thrust upward into late May then profit taking began

(pullback into area “D”). As shown in the “exit” box, the

second ½ position was sold for a $3.38/share profit (+14.7%).

The position was re-entered in late June (not shown here).

The TSM

approach uses quality stocks as a vehicle to take short-term

profits (~55%), to eliminate quickly those positions that

reverse or don’t continue as expected (~40%), and to let strong

performers run so as to capture greater profits over a longer

term (~5%).

CLICK HERE TO LEARN MORE