TripleScreenMethod.com

Further Thoughts on Shorting Stocks

from www.CANSLIM.net (published July 2006)

Richard W. Miller, Ph.D.

In the April issue of CANSLIM.net News, I discussed the TSM method for shorting stocks (“A Fundamentals Approach to Shorting Stocks”). In a nutshell, TSM’s long candidates are based on superior fundamentals, upward earnings revision fuel, remaining value and technical pullback criteria. Conversely, TSM short candidates are based on the reverse, i.e., inferior fundamentals, down word earnings revision fuel, overpriced value and technical recovery into areas of resistance. I’ll discuss shorting watch outs in this issue and offer two further candidates.

In that issue I presented a shorting example:, KOSP, which on 3/20/06 was trading at $49.79. Today, some 3 ½ months later, KOSP is trading at $37.62. Further, since the 1st of April, TSM has presented 15 other shorts of which 12 ½ were profitable generating an overall gain of $17.87 with each of these trades lasting an average of six days. Shorting can be profitable, but it’s also more difficult than strictly playing the long side like a CANSLIM investor might be more inclined to do. So why should you be interested?

The market doesn’t always have an upward bias. In fact, as I presented in the June issue of CANSLIM.net News (“The Health of Today’s Market”), since May there’s been definite bearish pressure on the market. Last Thursday’s follow-through day (6/29/06) may mark the 6/14/06 minimum as a significant turning point, but it just as likely won’t. As I pointed out in the above report, this half of the year is best described: “In May, go away!” Simply put, if you trade this part of the year exclusively from the long side, profits will be difficult. And trading exclusively from the long side likely will become even worse as we approach the end of the decade and the massive retirement of the baby-boomer generation. Trading the short side is just another tool in the trader’s arsenal.

Note, instead of trading the down side by shorting, one could buy Puts or invest in Rydex Inverse funds, i.e., options or mutual funds that profit when the market falls—the latter even in an IRA account. Too, one can sell Puts to form a “covered Put” position and hedge a short position in the same way one might sell Calls to form a “covered Call” position and hedge a long position.

Assuming that one uses strict trade management guidelines (stops and profit targets), the only real threat unique to shorting a stock is the “short squeeze.” That’s a situation where a high percentage of a stock’s float (more than 10 percent) has been shorted; the stock’s not liquid enough; and something triggers an increase in stock price that leads everyone to try to exit their short positions simultaneously. This demand increases price, and the short position rapidly deteriorates as short holders wait to exit their positions.

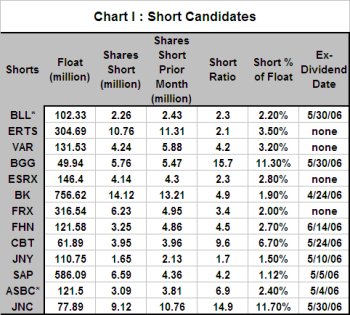

Chart I presents several short candidates that have been developed from the TSM short screens. The short ratio is the number of days that would be needed to clear the shorts given the average volume traded daily (require a maximum 5 days) and is a measure of liquidity. The short percent of float measures each stock’s susceptibility to a short squeeze (require a maximum 5 percent). Ex-dividend dates are included because any short position held on that day will force the holder to pay the dividend.

BLL and ASBC both have deteriorating fundamentals that meet TSM shorting criteria (both have Zacks ranks of 4 and this year’s PEG ratios of 1.58 and 5.68, respectively. Further, BLL’s earnings estimates have been revised down from $3.02 to $2.80 in the past 90 days, while ASBC’s have been revised down from $2.56 to $2.46. Their charts include the associated TSM trade management criterion for Monday’s market. Note, each has been in a multi-month decline and used last week’s rebound to recover to a point of resistance, i.e., a falling 20-, 50- or 200-day moving average, a prior price reversal or its top Bollinger band.

A free copy of the report. “8 Stocks to Short in this Down Market.” Can be viewed at the TSM website. Though the picks are now outdated, the TSM approach tying market health, sector strength and stock selection method together are described.