Slide 1

In

this video, the 3rd

in the TSM series, I want to talk about how quality TSM stocks are most

likely to advance over time.

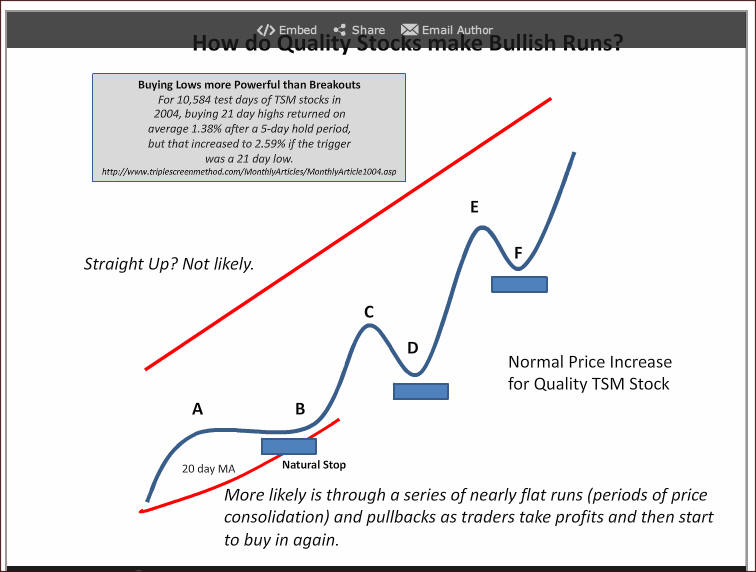

As you might imagine, no matter how good the stock is its price doesn’t just

go straight up like the red line.

The reason: at some point, those that own the stock begin to worry about its

rise and then begin taking profits, and as soon as they do, price begins to

fall or tread water just moving sideways. The real world is more like the

blue line for a quality, TSM stock.

From A to B, price has moved sideways towards its rising 20-day moving

average, as price consolidates after its recent gain. As the two come

together, the stock regains its bullish run to point C where stock owners

then begin to take profits and that selling pressure causes the price to

drop to D where the process begins over again, tracing out the E and F

pullback.

Over time, price makes a series of higher highs and higher valleys with

their turn points often supported by past highs and lows (not shown here),

by major moving averages (20, 50 or 200), by the common Fibonacci ratios

(something we’ll talk more about). Buyers are looking for opportunities to

enter the stock, and these are well known entry points.

If you want to hold the stock over time, each new valley or sideways

consolidation presents a natural place for stop placement, as shown by the

blue boxes, which rises as new valleys are traced out.

Statistical studies, mine as well as others, show that one will have greater

profit opportunities buying stocks in pullback rather than buying stocks at

their breakout, and that’s the basis for the TripleScreenMethod’s technical

approach.

For example, in a study that I did in 2004 tracking 36 TSM stocks over a

total of 10,584 trading days, buying a 21 day low returned 2.59% after 5

days, while buying a 21 day high returned only 1.38% - both profitable but

the pullback significantly more so.

Fibonacci

numbers are a special, but simple, sequence of numbers. The first 22 are

shown in column 2. The sequence starts with two ones then from there each

new number in the sequence is formed by adding the last two: 1+1=2, 1+2=3,

2+3=5, 3+5=8, and so on. Simple sequence but one with some very special

properties in a lot of different areas.

Let’s look at some of their special ratios. If you divide two adjacent

members in the sequence, the smaller one into the larger one, the ratio

becomes 0.618 (21/34) by the 9th

Fib number; if you skip a number, that ratio becomes 0.382 (13/34) and if

you skip two, the ratio becomes 0.236 (13/55). Subtract these ratios from 1

and 0.764 is added to the list of important Fib numbers that you’ll find in

many charting programs. For stocks in pullback, the important Fib ratios

are 61.8%, 50% (mid way between 61.8% and 38.2%) and 38.2%.

The “Golden Ratio,” a very special ratio, is formed by dividing a Fib number

by the one that preceded it (55/34). Geometrically, this represents a line

segment’s division point where the length of a line (A) divided by its long

segment (B) exactly equals the long segment length (B) divided by its short

segment length (C). Both equal 1.618, the Golden Ratio.

Instead of a line segment, if we divided a rectangle similarly, this golden

ratio would be aesthetically pleasing and one that highlights its point of

focus at the Golden Ratio; hence, it’s often used in architecting and in the

arts to stress focal points.

Slide 4

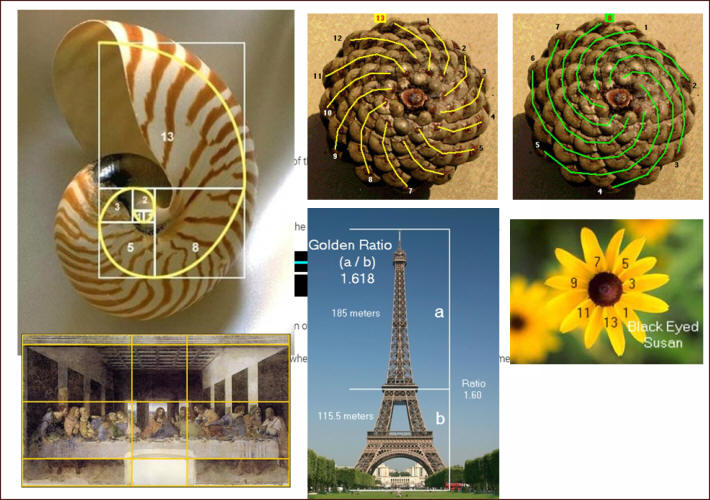

Let’s

look at a few examples in nature, one in art and another in architecture

(the dimensions of the Eiffel Tower).

Nature’s

spiral adds

Fib number sized squares as shown overlain on the shell where their

diagonals have been connected: 1, 1, 2, 3, 5, 8, 13 – the Fibonacci

sequence.

Pine cones viewed from the bottom show two sets of spirals: 13 in one

direction, 8 in the other – both Fib numbers.

The number of petals for many flowers is again a Fib number: here, the Black

Eyed Susan has 13 petals – again a Fib number

These are just a few examples. Fib numbers are used throughout nature

because they represent an efficient way to pack structures.

The relative dimensions shown for the Eiffel tower with its Golden Ratio

overlay shows the intermediate level as a focal point of the structure by

design. The whole structure becomes more aesthetically pleasing as a result

of these proportions.

Similarly, by design, there are many rectangles with their respective Golden

Ratios used in da Vinci’s The Last Supper to control different focal

points. Note too, it depicts Jesus and his 12 Disciples (13 again a Fib

number).

Such Fib numbers and ratios are found in lots of places. They guide us to

focal points in paintings, are aesthetically pleasing in architecture and

these same paintings, and they are optimal packing arrangements in nature.

Now let’s see how they influence pullbacks in our stock charts.

Slide 5

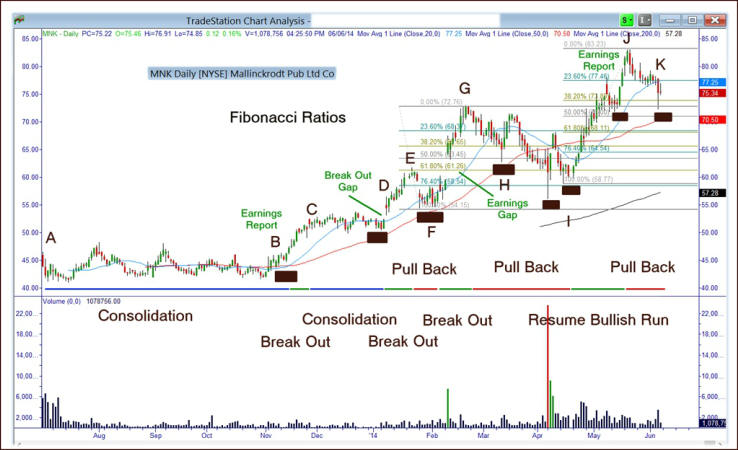

Now

Let’s look

at

the

chart of MNK.

First, its general shape:

- From point A to B, MNK was in a period of consolidation and was range

bound for several months;

- Then an earnings report drove price higher to C, where it spent another

month and a half in consolidation, as price moved along its 20-day moving

average and approached its

50-day average;

- Note, the black rectangles, which mark natural areas for stops,

identify areas that should not be violated if the stock remained bullish;

- Finally, at D, price broke higher in what’s commonly known as a

break-out gap to point E which marks the point where price began to

pullback;

- Note too, the stop could be raised again, as MNK continued to make

higher highs in both its peaks and its valleys;

- Price consolidated again for about half a month when it broke away in

another earnings related gap, moving higher to G;

- From G, price pulled back to I making a short recovery at H where

another stop could be set;

- The pullback to “I” would likely have violated the stop at H and forced

one to exit the position;

- From I, price resumed its bullish run to J where it began another

pullback to K.

Points of Interest in this chart:

- Strong TSM stocks usually alternate between bullish runs and periods of

gain consolidation or pullback; these are normal for strong stocks;

- The higher highs and higher valleys enable you to control risk with a

stop loss strategy so long as the stock continues its bullish run; when the

stock turns over, these stops are

violated and the position exited;

I prefer to enter a position at the valley of a pullback as opposed to a

breakout from consolidation because the risk control is better; with regard

to pullback expectations, let’s talk about gaps and Fibonacci levels;

Gaps as shown at point D and F are natural areas of support; frequently

price will fall back and test the gap (both at its top and at its bottom); F

is an example of price falling back to the top of the gap, as is H, while I

is an example of falling back to the bottom of the earlier earning’s gap;

Two sets of Fib ratios are shown”

Connecting the low of point F with the high at point G defines a distance;

Fib percentages likely areas of support;

- In the pullback from G, the 38.2% Fib level offers support, then at

H price temporarily bounces higher before falling to the support of its 50%

and then to its 61.8% Fib levels

of support;

- Similarly, defining the climb between the low at Point I and the

high at point J, again the 38.2% Fib level has offered support and continues

to do so as I write this.

In summary, then, good stocks pullback. They find spring board-like

recoverys at the support of Gaps, prior highs and lows and at the common Fig

levels.

Slide 6

SWC

offers another look at the price

road traveled by a strong TSM stock: Consolidation, Rise and Pullback;

Note the steadily rising stop values as SWC makes a series of higher

valleys;

I particularly like the support given by the 200 day moving average in

January and later by the 20- and 50 day moving average;

The first set of Fib numbers defined by the minimum in the cup formed

between A and B and the max at C shows how the pullback from C is again

supported by these special Fib levels:

- first, the wide-range bar falls to the support of the 38.2% Fib level,

then on to the support of its 50% and on to the 61.8% where it reverses

higher;

- more recently, the climb between H and I has defined a set of Fib

levels that again were supportive at the 38.2% and 50% level before

reversing higher.

Finally, notice two other aspects of the chart: as the A to D cup & handle

played out, most of the higher volume peaks in green are found on up days;

too, the pullbacks shown were accompanied by falling volume, often another

sign of strong stock pullbacks.

Well there you have it, the Triplescreenmethod’s technical approach to

buying quality stocks. Until next time, this has been Ric Miller, creator

of the TripleScreenMethod. Thanks for listening.

|

|