Hi

everyone. This is Ric Miller again talking about TripleScreenMethodís

investment and trading

strategies.

Iím

going to spend the next few minutes

describing

my favorite strategy:

selling

deep

out-of-the-money Puts for income.

Itís a

conservative strategy designed to give one a consistent return on a pile of

money Ė something that youíre not going to find with many other vehicles

today.

Letís

say you have $1 million dollars saved that you hope can provide income for

the rest of your life. As I speak, you could buy a 1 yr CD that yields

1.1%. That vehicle would provide you $11,000 to live on for the year. Not

many of us could live off of just that interest so what happens? You start

to eat your capital, and before you know it youíre broke.

Thatís

why Iíve combined TSM stock picking, based on stock fundamentals and value,

with an option approach that will provide conservatively a 10% plus return

on your pile of cash: or here, $100,000 to $150,000 a year

on your $1,000,000.

In this

presentation,

Iíll explain the strategy and its metrics (annual yield and % downside

protection) and show you how to calculate them. Further, Iíll show you how

I select the ones I personally trade.

In later lessons, Iíll discuss ways to minimize a loss when the trade goes

bad, which occurs ~ 5% of the time.

So lets get started with just what is a Put? Well, a Put is one of two

types of options, and they are available on nearly all TSM stocks and trade

just like the stocks themselves do.

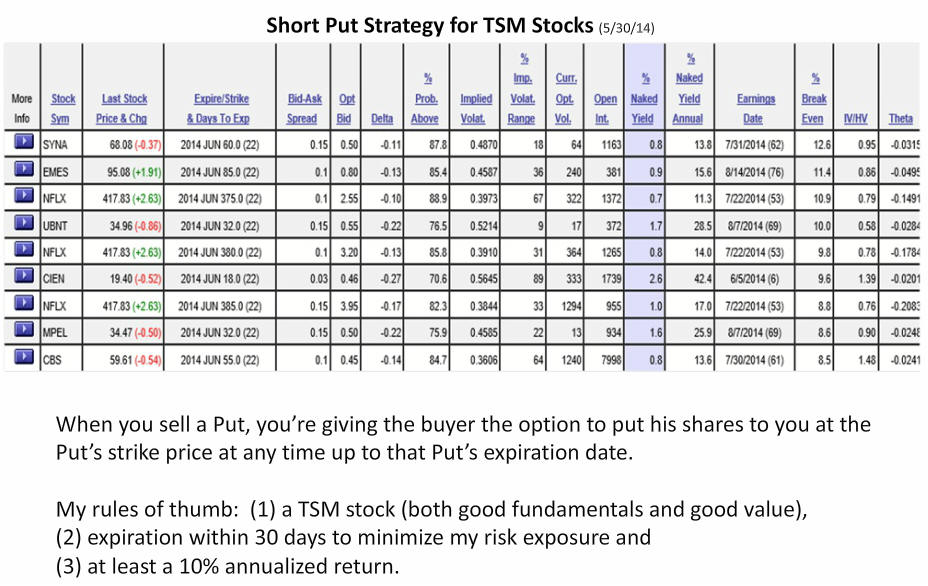

When you sell a Put (a contract usually on a hundred shares), you give the

buyer of that Put the right, but not the obligation, to put his shares to

you at the Putís strike price. And he or she can do this at any time up

until that options expiration date. In effect, you become an insurance

policy for his stock blowing up. And for that he pays you a premium. The

Put buyerís actions are very similar to his buying insurance for his home

where he pays a premium for protection from it burning down: the strike is

the insured price of the home and the expiration date is the life of the

policy. Think of my short-Put strategy as you becoming the insurance

company.

My rules of thumb for the short Put trade: (1) I use Puts for TSM stocks

which have both good fundamentals and good value remaining, to ensure lots

of institutional support as a safety net; (2) I only sell Puts that have 30

days or fewer before their expiration to minimize my risk exposure; (3)

finally, I expect at least a 10% annualized return though often I get much

more than that. Quality underlying stocks, risk control and a good return

on my pile of money.

__________________________________________________________

Click to get the Poweropt set of Puts for the TSM screen.

So how do I find the specific Puts that Iím looking for? Good question.

I use a powerful option screen. First, I provide it a listing of all the

TSM stocks for the week and the expiration month that Iím interested in,

always whatís called the front month. In real time, it then gathers data on

all the available Puts for these stocks and rank orders them by their risk

control measure, something that I call % downside protection and the screen

calls % break even. Expressed as a percentage of price loss, it tells me

exactly how much the underlying stock for a particular Put can fall before I

experience any loss.

Hereís an example of the screen that I ran end of day on 5/30/14. Letís

spend a little time talking about the various columns of information, what

they mean and which ones I consider important. Note, I provide this screen

every evening in the TSM daily report, and I email specific Put plays that

Iíve just made during the day.

-the

first two columns identify the underlying TSM stock involved and its end

of day price with change from the prior day; SYNA was the top stock on

the list Friday.

-the

third column identifies a particular Put for SYNA (one of many that it

has), specifically its $60 Put expiring on the third Saturday in June,

thatís in 22 days from now; note, selling this Put (called writing this

Put in the option world) would obligate me to buy SYNA shares (100

shares per option contract) at $60 a share anytime the seller wished to

sell them to me over the next 22 days; and why would the owner of the

Put contract want to sell his shares to me? One reason, his shares have

fallen below $60 during that time. We protect ourselves from that

situation by dealing exclusively with TSM stocks characterized by strong

fundamentals and by limiting our exposure to 22 days, but even so, about

5% of the time, this will happen, and weíll get shares put to us that

weíll have to deal with in our stop loss strategy, but thatís a subject

for another video.

-the

next two columns show this Putís option premium spread and its bid

price: the first is a measure of the Putís liquidity (I limit the

screen to finding Puts where this spread is 25 cents or less), and the

second is the minimum premium that I could expect to take in when this

screen was run (I always try to get the mid price between the bid and

ask values; here the ask price would be the 50 cents plus the 15 cent

spread);

-the

next six columns deal with this Putís specifics:

Delta

tells me how much the premium will change when the underlying stock goes

up $1, e.g., if SYNA goes up $1 on Monday, I could expect its 50 cent

premium to drop by 11 cents; Delta is also the approximate probability

that SYNA shares will finish below $60 over the next 22 days (an

approximate 11% chance here); the exact probability calculated from a

number of factors that I wonít go into here is a 87.8% chance that SYNA

shares will finish above $60, and I will just keep the premium; I prefer

delta to fall below 0.15; note too, that these probability estimates do

not consider technical factors, e.g., where areas of support and

resistance might lie. Technical factors, I believe, are the reason that

less than 5% of these get put

to me, even when the delta would predict more than that.

Implied volatility

is an annualized measure of SYNAís future price variation expected by the

option market maker; itís directly related to the Putís premium, i.e., the

greater the volatility, the greater the premium; for me, the important

thing is how this future volatility relates to SYNAís past historical

volatility; the next to last column (IV/HV)

shows that ratio, e.g., here at 0.95, the future volatility is expected to

be slightly less than its historic volatility over the past 50 days; Note,

I would prefer this ratio to be well above 1.0 because that indicates the

Putís premium is rich relative to its historic volatility; note too, in

periods of rising stock prices like weíre now experiencing in the market,

the implied volatility for Puts, hence their premiums, lessen.

The

% implied volatility range

shows how the current volatility relates to the range of volatility this

option has seen over its life; here, itís at the 18% level; its volatility

has been higher 82% of the time; obviously, we would prefer this number to

be greater than 50% because that would indicate again the option was rich in

premium; further, if it were greater than 50%, you might expect the law of

reversion to mean would favor the implied volatility dropping, hence its

premium dropping, and thatís always a good thing when youíve sold the

option. If this 50 cent premium drops to 5 cents, I would be inclined to

buy back the Put, close the position, and look to open another position that

month with richer premium.

The

current option volume

is the number of this optionís contracts that have been traded today, and

the

open interest

is the total number of this optionís contracts that are currently open, not

necessarily traded today but open; both are measures of the optionís

liquidity;

While weíre talking about option characteristics, letís talk about

Theta,

the last column; itís the change expected in the option premium due to the

passage of one dayís time; remember options are wasting assets which lose

their value every day, even if nothing else changes; e.g., with SYNA, I can

expect its 50 cent premium to drop by 2 x 3.15 cents by Monday morning when

two days will have passed.

Thereís an

Earnings Date

provided with the number of days before that date is reached in parenthesis

because that day is likely to move the underlying stock price and option

premium so you need to be aware if itís coming up in the next 22 days;

often I will write a Put intentionally to include an earnings report because

the approach of an earningsí release typically inflates an optionís premium,

but when I do, I always insist on good downside protection;

The final three factors are the most important to me, show stoppers if

you will:

two yield measures

and a

% break even

(or what I call % downside protection). The % Naked Yield is the return I

would receive over the 22 days, considering the premium relative to the

amount of money that would be set aside in my account until this option

contract was resolved; itís assumed that you will have to set aside the

strike price times the number of shares involved (100 shares per contract);

for example, if I sold 1 contract of SYNA Puts, I would have to set aside

100 x $60 per share Ė50 cents per share premium or $5,950. The return would

then be $50 / $5,950 = 0.84% (a little different than the 0.8% stated in the

table because they do not correct the $6,000 set aside for the option

premium received. These estimates are what you would be required for an IRA

account; a typical equity account would require less money be set aside in

your account, hence

give an even better return. The

annual return

is simply the return you could expect if you made this same investment every

22 days for a year.

Finally,

the % break even

is simply the percentage that SYNAís price must fall before I, as the Put

seller, would start losing money; along with the chart characteristics,

yield and delta, this percentage is the most important factor to me; itís

the basis for which all these options are ranked.

Having said all this about SYNA, the Put that I chose to write was the

second one on the list, EMES, because I liked its fundamentals and chart

better.

__________________________________________________________________________________________________________

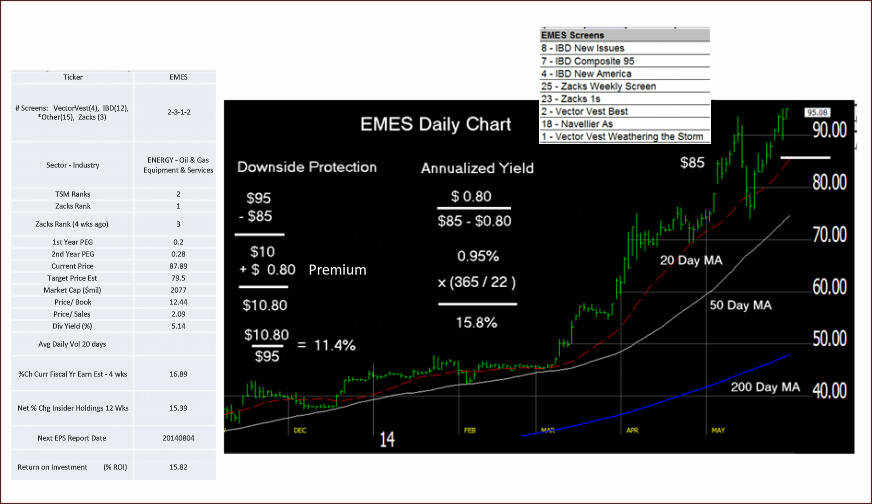

EMES Fundamentals

After running the option screen, I look at the fundamentals of the stocks

that Iím considering. Note, each evening I also provide this fundamental

data for all the Puts under consideration.

EMES fundamentals are shown here.

It holds membership this week in 8 of my screens: the set of four

numbers separated by dashes tells me that 2 of the screens are Vector Vest,

3 are IBD, 1 is from a variety of other sources (here Navellier) and

finally, 2 are from Zacks. The particular screens are listed.

TSM ranks each of its stocks on a 1 to 6 scale, the higher the better

(particular criteria can be found at the TSM site); Zacks ranks stocks on a

1 to 5 with the lower numbers the better; Zacks rankings are proprietary,

based on a number of earnings criteria; they are simply the best ranking of

stocks available.

The target price is based on earnings valuation methodology. Of

course, I would prefer my Putís strike price to be lower than this target

price, because ultimately, I could be owning the stock at that price.

PEG ratios (Price to Earnings to Earnings Growth ratios or another way

of looking at it Price divided by (Earnings x Earnings Growth)) are measures

of value, and the lower their value the better the value at the stockís

present price. I use two PEG ratios; the first is based on this yearís

earnings growth and the second based on the following yearís estimate.

For me, the important fundamentals in their order of importance:

Zacks Rank (can be a 3 if Market Cap > $10 billion) Ė PEG ratios Ė Target

Price Relative to Strike Price Ė Price/Sales Ė Which source have them ranked

in their Screens

_____________________________________________________________________________________

EMES Chart

Letís now spend a few minutes looking at EMESí chart.

I like the fact that it has been steadily moving higher with good

support from its 20-day and 50-day moving averages.

I wrote the $85 Put, shown by the white line on the chart for an 80

cent per share premium and guaranteed that over the next 22 days I would buy

100 shares per contact for $85 a piece. Note, the 20-day moving average

support right there.

The % Downside protection is calculated as the difference between the

current price and the Putís strike price + the per share premium. Here, the

current price is $95; the strike price is $85, and the premium is 80 cents.

EMES shares would have to fall by $10.80 over the next 22 days before I

would start to lose money. Thatís 11.4% relative to the current price.

The yield is again a simple calculation. Here, its 15.8% annualized.

|

|