|

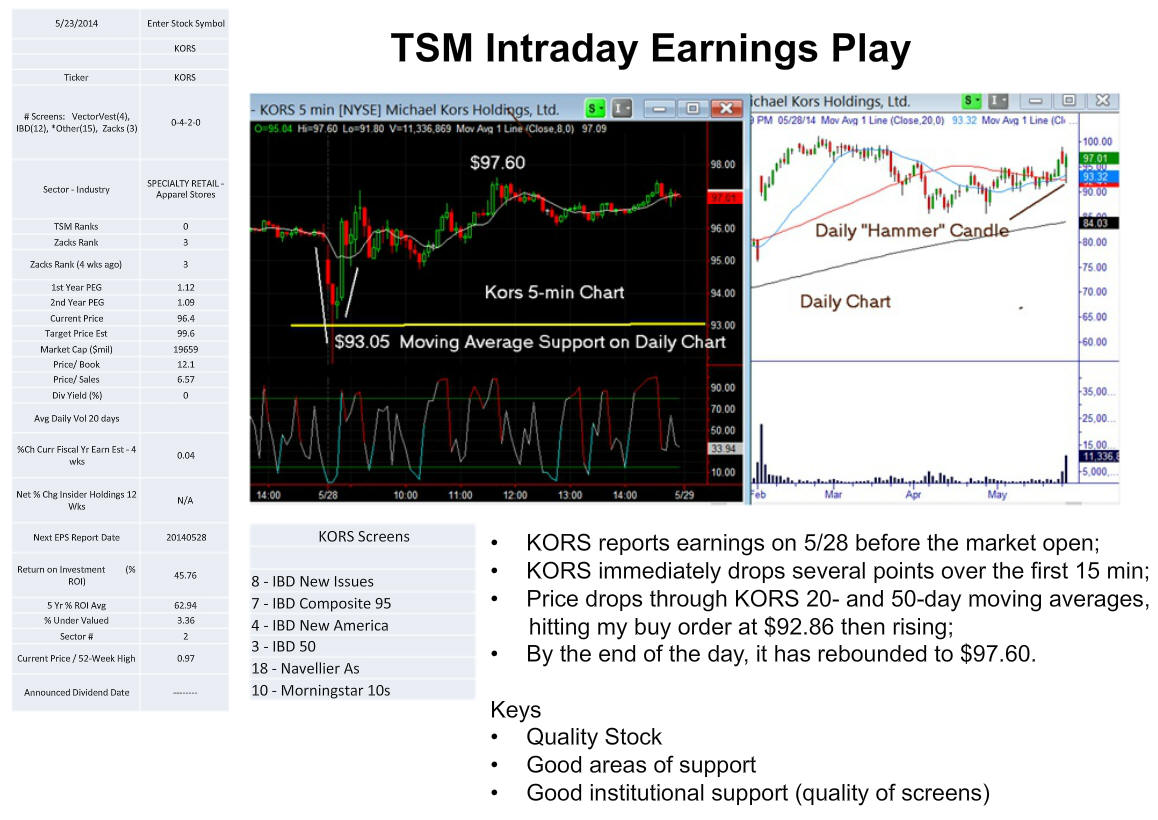

Lesson #5 - The TSM Earnings Play

I want to tell you about a trading strategy that I

use for TSM stocks during earnings season. Specifically, I'm looking for

TSM stocks that have just reported earnings either the night before or

the morning before today's open. Further, I'm looking for the TSM

stock that reacted badly to the report by diving at the open.

Simply put, I'm going to identify likely areas of

support (major moving averages, areas of prior highs or lows and

possibly major Fibonacci levels). Before the open, maybe the night

before, I'll place a buy order at or just above the support and then

hope to catch the fall.

Well KORS was just such a play, strong

fundamentals, particularly low PEG ratios. It dove at the open

over the first 15 minutes, ran through my buy price, then rebounded.

In a three hour period, KORS had rebounded by $4.5.

Keys:

Every Sunday, I put together a list of TSM stocks that will

report during the week, along with their fundamentals. Further, I list

the winners with explanation on the main TSM page.

|

| |