"An Approach to Successful Stock Trading

Combining Company Fundamentals with Chart Technicals" |

Sunday, March 23,

2015

SPECIAL REPORT

|

The

Married Put Trades with TSM Stocks

Married Put Strategy (MPS): TSM

stock trades (building capital) are executed over the short term: on

average, each trade takes 6.7 days. The TSM Short Put trade (generating

income) will average less than 30 days. The third leg of the TSM system,

the Married Put trade (income and capital in an iffy market) will last 6

months or longer. In an uncertain market, you want to use strategies that

hedge risk, and that's what the Married Put Strategy does.

The MPS marries a long

TSM stock position with a long in-the-money Put. It's goal is to generate

income and capital in a risk free way. It's a simple concept, probably best

seen by an example. See the following table.

________________________________________________

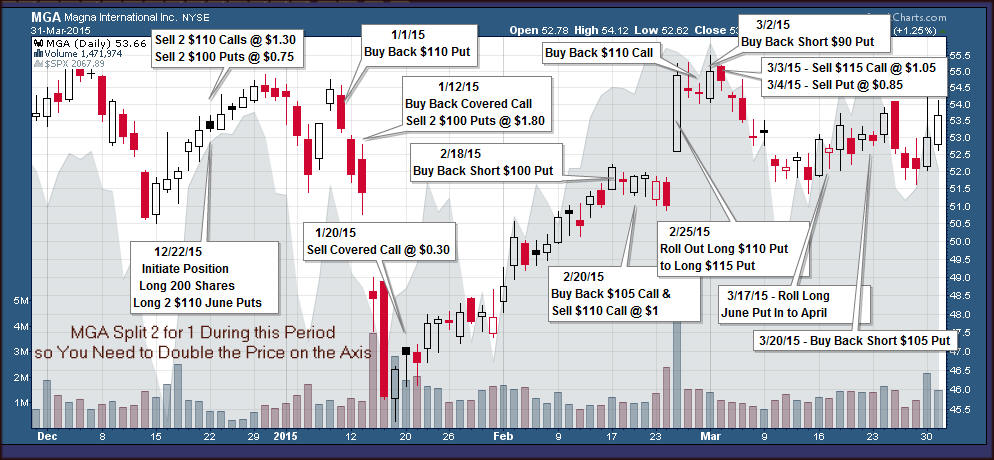

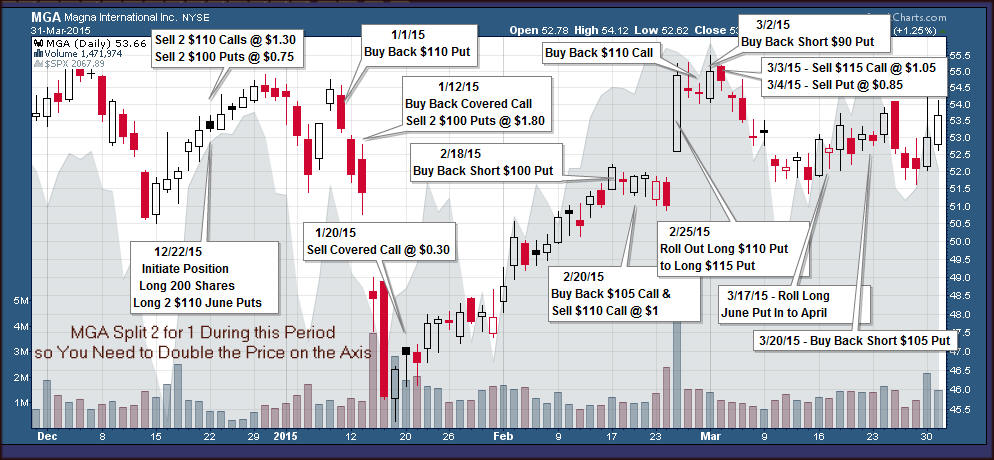

1 -

MGA, an Example of the Married Put Strategy (Complete 3/31/15 for 9.76%

Annualized Yield Over 99 Days)

-

TSM stock that I'm willing to take a 400 share position (trading at

$106.67 on 12/26/14)

-

12/22/15 -

Buy 200 shares and 2 long Puts (June $110 strike) for $9.90

-

My per share cost: $106.67 + $9.90 = $116.57 plus $4 commission for the

two trades ($21,334 invested in the trade)

-

The long Put guarantees me that I can exit the trade at the June

expiration (6 months from now) for $110 so I really start the trade with

only $6.57 per share at risk, and my goal becomes to generate cash to

eliminate the entire risk

-

12/22/15 -

Immediately, I sell Calls ($1.30) and sell Puts ($0.75) {potentially

build the 2nd half of the position} to reduce my risk to $4.52; note, on

a per share basis, the commission for each of these trades costs $0.01

-

02/20/15 -

As the trade progresses, I buy those short positions back and sell more

so by February, I had reduced my risk to $1.32 as MGA's price had fallen

back to $103.97

-

02/25/15 - Five

days later, as MGA's price had climbed to $110.03, I rolled the long Put

(June $110) up to the June $115, which generated more income ($2.06)

-

03/17/15 - Rolled the $115 long

Put in to the April $115 Put, which again generated income ($1.45); at this

point, I was $2.31 beyond a risk free position, i.e., MGA could fall to

zero, and I would still earn this amount

-

03/27/15 - I received a $0.44 per

share dividend

-

03/31/15 - I closed the position:

sold the long Put and the 200 shares (note, MGA split 2 for 1 when it paid

the dividend, but I did not show that here for ease of computation

-

I ended up making $2.82 per

share, while MGA shares increased $0.57 from $106.67 to $107.24 during these

99 days

____________________________________________________________

2

- UVE,

Another Example of the Married Put Strategy (3/18/15)

Stats Of Hits

Copyright 2006

TripleScreenMethod.com

It should not be assumed that the methods, techniques, or indicators presented

in these pages will be profitable or that they will not result in losses. Past

results are not necessarily indicative of future results. Examples presented

on these pages are for educational purposes only. These setups are not

solicitations of any order to buy or sell. The author assumes no

responsibility for your trading results. There is a high degree of risk in

trading. I am not recommending that you purchase or short stocks or options

using the techniques and methods presented in this report. Trading should be

based on your personal understanding of market conditions, price patterns, and

risk. I present here information to contribute to your understanding a

technique that has worked well for me.

|