As I write this, the S&P is making all time highs (as is our national

debt). Obviously, the market has been the place to be over the past year,

even as the world has become increasingly dangerous, and the likelihood of a

market turndown on any trigger event likely. At the same time,

interest rates have been held down by the Fed in an attempt to soften our

economic situation, and in so doing, that strategy has made it difficult for

anyone with a pile of money to earn a decent return on it. For

example, a retiree with a $1,000,000 could only earn $25,000 annual

investing in 10-year treasuries. Using the conservative strategy I'll

describe here, that retiree could be earning $150,000.

In this report, I’ll describe that conservative

approach to earning a 15 percent return on your money or to buying quality stocks at big discounts

in price. This

time-tested strategy is built around

selling options (called “writing” options in option jargon), specifically

cash-backed, deep out-of-the-money Puts, to

generate income or buy quality stocks at bargain prices. The

strategy is deemed conservative for two reasons: (1) the underlying stock

has both strong fundamentals and value remaining at its current price; (2) if we are

forced to buy this stock, it's at a 10-25% discount to its current price.

Before describing the strategy

in more detail, let me describe what stock options are for those

of you that might have heard of them but never used them or, worse, for those of

you who think of them as extremely risky strategies.

What

are Options?

Options are simply contracts, most controlling a

100-share block of the underlying stock or Exchange Traded Funds (ETFs). Once your brokerage account has

been properly activated, options are as easy to buy or sell as the stocks

themselves. However, for all but the most heavily traded stocks and ETFs,

the bid/ask spread of an option trade will be wider than that of its underlying

vehicle. They just aren’t as liquid.

Today, one can buy or sell

(write) option contracts on over one-fourth of the stock universe, as well as

on most indices (as ETFs) and other ETF’s as well, e.g., country, sector

specific and even inverse ETFs. Each such vehicle has its own option string,

i.e., a number of different contracts differing in their time of expiration

and their strike price. All effectively expire on the third Friday of their

expiration month (technically on the Saturday). Most can be written for the

next several months, while some can be written years into the future (Leaps).

The underlying vehicles cited in the rest of this report will be stocks.

There are two basic types of options: Calls

and Puts. The value of a Call rises as the price of its underlying stock goes

up, while the value of a Put rises as the price of its underlying stock falls.

A whole arsenal of strategies can then be fashioned around simply buying and/or

selling these Puts and Calls singly or in defined combinations, e.g.,writing

Naked Puts or Covered Calls, going Long Calls, writing or buying Debit and/or

Credit Spreads, etc .

Puts give the buyer of the

contract the right, though not the obligation, to sell to the Put seller (writer

of the contract) the underlying 100 shares of stock at any time up to its

expiration date at a specified price (the option’s strike price)—no matter what

the price of its underlying stock at the time of the sale. Conversely, Calls

give the buyer of the contract the right, but not the obligation to buy stock

from the seller of the Call’s contract at the contract’s strike price. For

these rights, sellers of either option type are paid a premium. Truthfully,

trading options is no more complicated than that, but two analogies should make

their usefulness clearer.

A Put’s Similarity to a Home’s Insurance Policy

A Put acts

like an insurance policy for the buyer in much the same way an insurance policy

protects your home. You, the homeowner (Put buyer) buy the insurance from the

insurance writer (Put writer) to protect against a catastrophic loss. The

insurance writer (like State Farm), on the opposite side of the transaction,

collects the premium and profits from insuring these low-probability losses.

Sometimes a hurricane Ivan happens, but most times the insurance company sits

back, collects premium and grows rich (it’s been Warren Buffet’s road to

riches).

Back to Put options, the writer

of the Put is paid the option’s premium and, for doing so, guarantees the Put

buyer that he will buy the underling stock at an agreed upon price (the strike

price) at any time up to the option’s expiration date at the Put owner’s

discretion. The writer of the Put, in effect, writes an insurance policy for

the buyer of the Put: the seller gets the premium (income), and the buyer gets

the guarantee that his stock’s price can not fall below the option’s strike

price through the option’s expiration date.

Note, a cash-backed Put writer will have his cash

escrowed in his brokerage account when he writes a Put so if he's forced to take

possession of the shares when the price falls below the Put's strike price, it happens immediately.

For example, if stock XYZ were trading at $50,

and one purchased its $50 Put for $3—one that expired in 30 days—the Put buyer

is betting that between now and 30 days from now XYZ will finish below

$47. The writer of the Put, on the other hand, thinks

XYZ will hold its value or rise over the next 30 days and just wants the $3 for income or, failing that, wants ultimately to

own XYZ {trading at $50 today} at the reduced price of $47 if he’s later forced

to buy the stock's drop. The buyer controls that $50 stock for three months at a fraction of its

value (just $3 versus $50). What makes this option trade more risky than

shorting the stock outright is that the Put seller's total liability should

the stock rise say to $75 is again limited to the $3 premium (unlike the $25 full

loss experienced by the short seller).

Typically, buying Puts serve two

purposes: (1) someone believes a stock’s price is ready to fall and wants to

trade that way, or (2) someone holding a stock position wants to protect from a

collapse (i.e., they want to hedge their portfolio)—a kind of

insurance if you will. Those writing Puts similarly do so for two

purposes: (1) to generate an income stream but not own the stock, or (2) as a

strategy to buy stocks tomorrow at a cheaper price than it's trading at today. It’s

these latter two strategies that are developed in this report.

Calls give buyers the right, but not the

obligation, to buy a stock up to some specified point in the future at a

specified price. They are betting on a price rise in the underlying stock

and are leveraging their cost, while sellers again look to generate income. If

the seller already owns the stock on which he is writing Calls, the options are

commonly referred to as “Covered” Calls. I'll say no more here about

strategies involving Calls, though I frequently write covered Calls to mitigate

risk when shares are put to me.

Now, let me add some prospective

to option buying and selling. Once you understand the probabilities involved in

trading options, you will look for strategies that involve selling options

(writing Calls and Puts) to

take advantage of the high likelihood for options to expire worthless.

Options Tend to Expire Worthless

A study analyzing three years of

data (1997-1999), compiled by the Chicago Mercantile Exchange, confirms that

option sellers are the true winners over option buyers (John Summa, “Option Sellers

vs. Buyers: Who Wins?,” Futures Magazine, March 2003). His

study, based on the option characteristics of five commodity markets (S&P 500

index, Nasdaq 100 index, Eurodollar, Japanese yen, and live cattle), showed that

over this three-year period an average of 76.5 percent of all options expired

worthless. Even during this bull market period where prices were rising

greatly, 74.9 percent of all Call options expired worthless and 82.6 percent of

all Put options did likewise. Three patterns emerged from the study: (1) three

of four options held to expiration expired worthless; (2) the percentage of Puts

to Calls expiring worthless depended on the primary market trend; and (3) option

sellers were invariably the winners.

The Short Put Strategy

With that as an introduction, let’s see how one can mold these Puts into an effective income

strategy, one that can consistently generate a 15% return on quality stocks. You’ll notice that most calculations ignore commissions ($1 per

contract for me), and sells are conducted at bid prices and buys at ask prices.

Too, understand that if the underlying stock's price drops below the Put's

strike price at expiration, that stock is put to you at the strike price cost.

Tips on Writing Naked Puts

Writing deep, out-of-the-money Puts, as a strategy, is more conservative than

just buying stocks. Consider, over the next 30 days, a

stock’s price can do one of five things: go up a lot, go up

a little, stay the same, go down a little or go

down a lot. The stock owner profits in two of those

scenarios, while the Put writer makes money in four of the

five and still doesn’t lose as much as the stock owner in

the fifth when the “stock falls a lot.” Admittedly

though, the Put seller doesn’t make as much as the stock

owner when the stock goes up a lot. Having made that

point, let me offer a few tips on using this strategy.

Tip 1:

Write Puts on fundamentally sound stocks that you wouldn’t mind owning

at substantially reduced prices (TSM stocks meet this

criteria);

Tip 2:

Make sure underlying stock’s price lies above its 200-day

moving average, as that’s an indication that this particular

stock’s price has not broken down and lost its institutional

support; if possible too, write a Put whose strike price

falls below a major area of support;

Tip 3:

Put premiums become richer in uncertain times, as people

rush to buy protective Puts, so one can write deeper

out-of-the-money Puts and still get his targeted return, say 15 percent

annualized;

Tip 4:

In an uncertain, bearish market, trade smaller size and demand

greater downside protection;

Tip 5:

Trade liquid Puts with bid/ask spreads less than $0.25 in

case the trade goes against you and needs to be closed;

Tip 6:

To reduce risk trade write Puts with 15-30 days till

expiration; note, this is not the same as closing early a

longer term option because those will be impacted negatively

by increases in volatility, while the former is a rapidly

depreciating asset;

Tip 7:

Be particularly aware of when the next earning’s report is

coming out

because premium inflates as that date approaches; further,

the risk of a post-report selloff increases in an edgy

market;

Tip 8:

Quality stocks that have pulled back (ideally where we want

to write the option) are apt to bounce higher quickly and

significantly reduce the premium of a short Put position; as

soon as a short put position is created, place a limit order that closes the order

automatically (for me, when the Put is worth $0.05) because

(1) the risk/reward is not in your favor and (2) that capital can be redeployed

in a new short Put at

a higher rate of return;

Tip 9:

Write Puts on stocks that have pulled back into an area of

support, e.g., 20/50/200 day moving averages or prior highs

or lows.

Tip 10:

Always understand the level of downside protection with a

new Put position and favor getting better downside

protection over getting higher yields.

Identifying Fundamentally Sound Stocks to Write Puts On

The

TripleScreenMethod approach to identifying stocks used in

writing Puts is to run 32 fundamentally based screens from a

number of commercial services, e.g., IBD, Value Line,

TheStreet, Navellier, Zacks and many others. Once this

weekly list is generated (2,000 to 3,000 entries), cross

screen references are noted, and then the list is reduced by

requiring:

-

Zacks ranking of 1-3

with 3s forced to have a market cap greater than $9

billion

-

Daily average volume

greater than 100k

-

Two-year PEG ratios

less than 1.5, ideally less than 1.0

At this point 250-350 stocks have been identified for

trading the next week. In addition to

identifying 1-3 stocks, usually in pullback to support, to

trade the next day, all front month Puts, available on these

250-350 stocks (more than 1,000) are ranked based on two

criteria: % annual return and % downside risk

protection where the latter is defined as follows:

% Downside Risk Protection =

(Present Price - Put's Strike Price + Put's Premium) /

Current Price

Depending on the time left

to expiration, 5-20 of these options are listed in each

evening's TSM report as potential plays for the next day.

An Example of TSM’s Short-Term Put Writing

Strategy

As an example of writing Puts as an income strategy, consider BIDU, the provider of Chinese and Japanese internet search

services. Its great fundamentals were evidenced by top

rankings from several independent services: Value Line, Zacks, IBD

and Morningstar.

Even so, BIDU had substantial value left at its current

price with 0.65 and 0.75 PEG ratios based on the next two

year’s estimated earnings growth. Moreover, this

year’s earning’s estimates had been increased: upped 29.5

percent over the last 90 days. By all accounts BIDU

was a great stock to trade, one that would have lots of institutional interest

at its major areas of support--our safety net.

As shown in the Chart, May offered several

opportunities to write Puts when, in a volatile market, BIDU’s price

had fallen to major areas of support (blue arrows

marking 5/6, 5/21 and 5/25) following a great earnings

report and gap up on 4/29 (horizontal arrow).

Table I details possible Naked Put trades. For example, on

5/6 BIDU was trading at $62.50 near the support of its

20-day moving average. Its $59 June Put (expiring in 44

days) could be written for $1.90 per share or its $55

strike, with its increased downside protection, at $0.95 a

share. Either strike falls well below BIDU’s 50-day moving

average which is the next likely area of support if price

should continue to fall. That first trade scenario

represented a 28.39 percent annualized return if held to

expiration and an additional 8.64 percent downside

protection from the current price. The second trade

represented a 14.68 percent annualized return with 13.52%

downside protection. Note, I recognize that this trade

doesn't represent the ideal 30 day time frame or 15%

downside protection, but BIDU had such good fundamentals an

exception was made.

Note, the percent annualized return calculations used here

assume that each position would be 100 percent

collateralized as would be required for an IRA account,

e.g., $5,710 ($5,900 - $190) would be frozen in the

brokerage account as collateral for each contract in case a

potential buy was necessary should the BIDU shares actually

be put to the Naked Put writer.

But this trade didn’t need to be held to expiration. Just

seven days later, price rose to $82.29, and the short Put

positions could be closed for $0.40 and $0.25,

respectively. These amounts represented 6.61 and 4.34

percent returns if the position had been held from that

point until expiration 37 days later. Of course, at this

point our cash collateral could be better used

collateralizing a different position.

Short-term BIDU trades presented themselves again on 5/21

and 5/25 and similarly could have been closed shortly

thereafter (each within three days) for substantial gains.

Obviously, in this market, it paid to

manage short Put positions instead of just putting on one

and holding it until expiration. In the BIDU $59 strike

series of trades, we increased our profit from $1.90 per

share to $3.70 ($1.90 – 0.40 + 1.65 – 0.65 + 1.60 – 0.40)

and, at the same time, reduced our exposure to the volatile

market’s risk from 44 to 13 days. That’s a 6.69 percent

return ($370/($5,900-$370)) for each contract (or 187.9

percent annualized) earned on money while one waits for the

next great stock buying opportunity.

Most evenings TSM’s daily report provides a list of Puts

available for TSM stocks that met the 18 percent annualized

return and 15 percent downside protection at the prior day’s

close. These screening criteria lessen as expiration

draws near. Often, the current day’s candidates are provided

intra-day via twitter “tweets” after I personally make the

trade.

Stopping

Losses

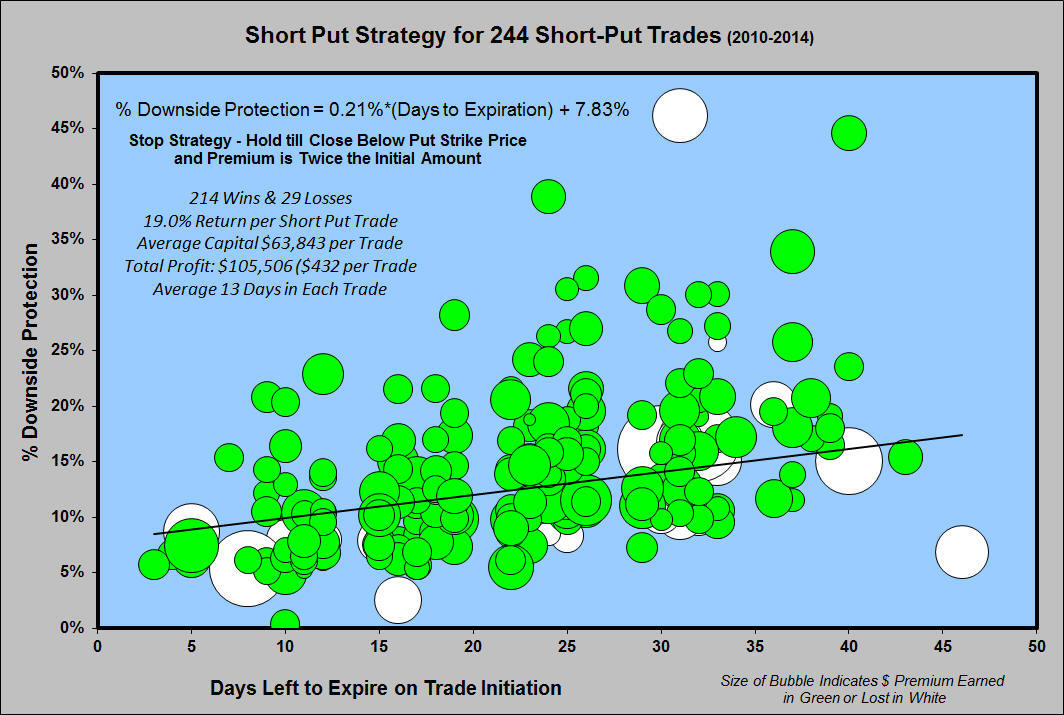

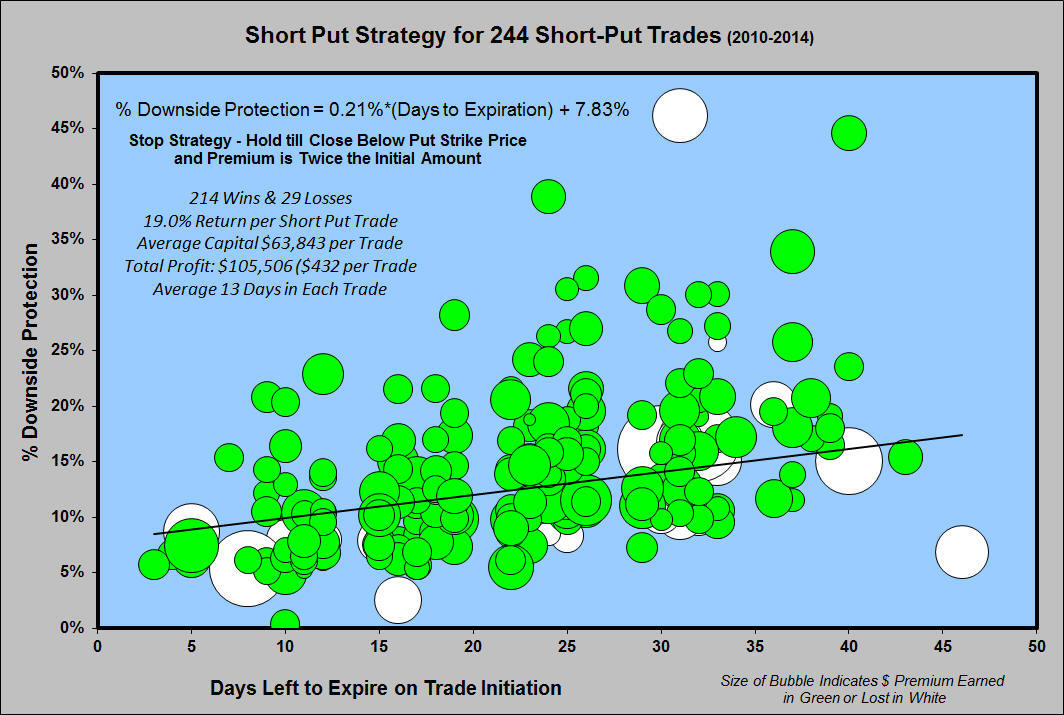

By 9/17/14, 244

Puts had been forecast providing premiums amounting to

$105,506: average profit $432 per trade, average time in

trade 13 days, average annualized return 19% for each and

average cash amount required to back each trade $63,843

(usually 10 contracts were traded).

This plot shows the relationship between days in the trade

and initial % downside protection for these past 244 short

put trades. There were 214 winners (in green) and 29 losers

(in white), and the size of the balloon indicates the size

of the premium captured.

Notice how nearly all these losses could be avoided if these

trades were limited to 27 days or less to expiration.

Its downside protection required as a function of time to

expiration is given by the following regression line:

% Downside Protection = 7.83% + 0.21% x (# of Days to

Expiration)

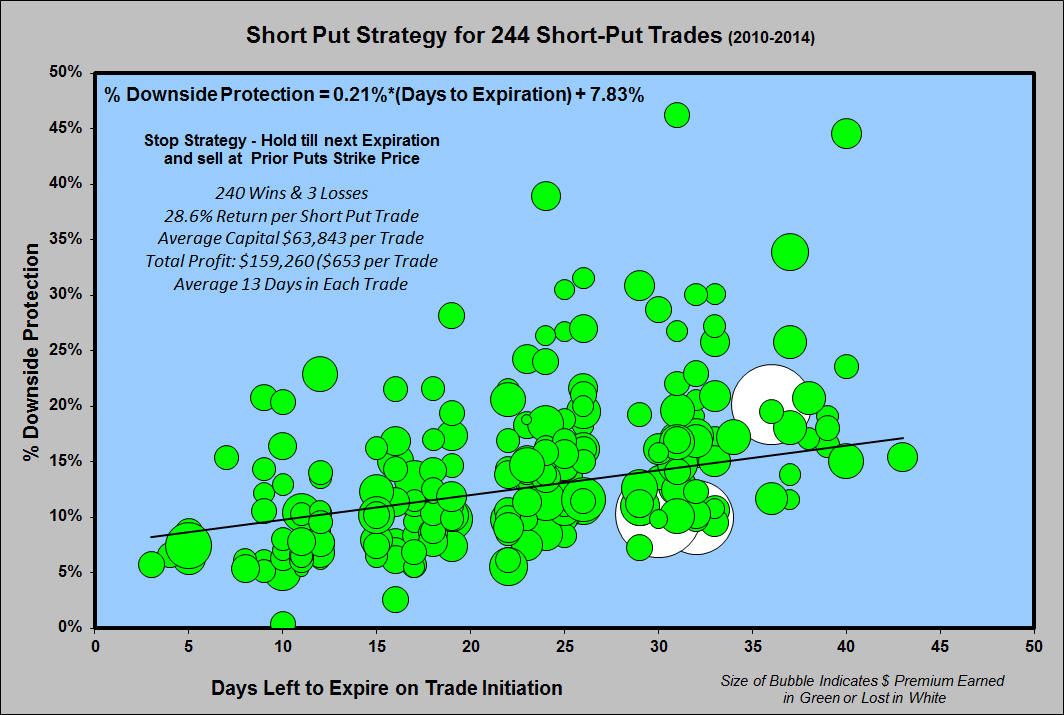

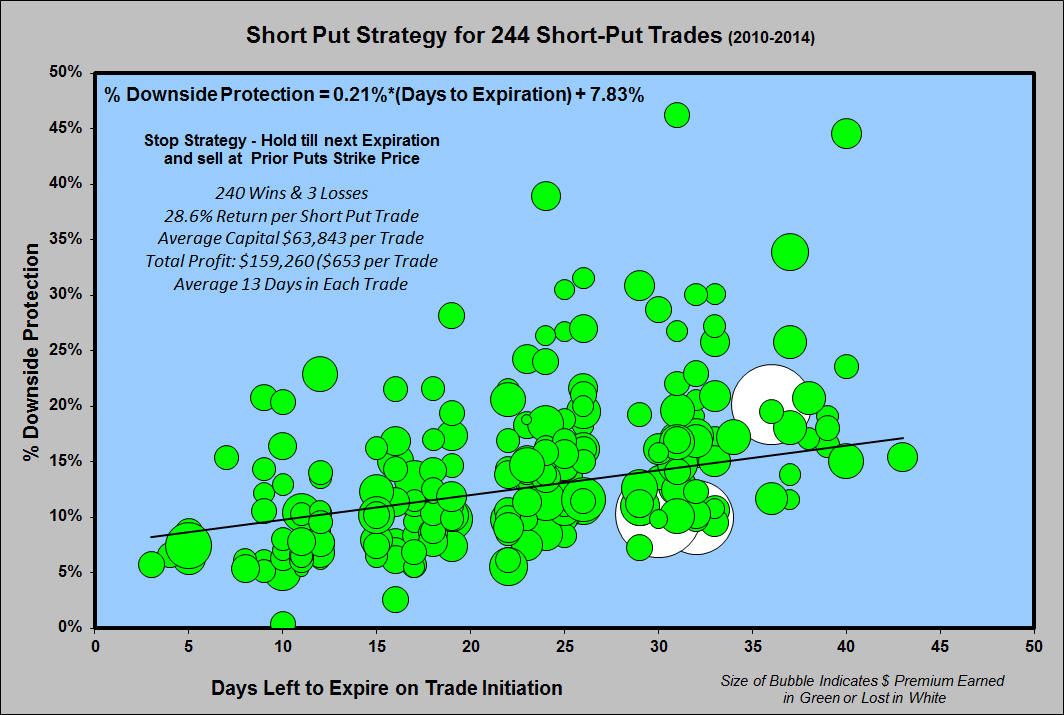

Notice how the profit situation improves to a 98.8% win

rate, as shown in the chart below, when the stop-loss

strategy is changed from immediately selling shares put to

me at a loss to when a losing position puts shares to me, an

immediate sell trade is entered at the Put's strike price

and held there up until the next month's expiration when

either the shares had been sold during this second month for a profit or

at the second expiration closed at a loss. This strategy

reduced the losses to 3 positions and increased the gains to

$159,260. This strategy is ideal for a quality stock.

The real key here is to deal only in quality stocks, i.e.,

those that have institutional support, i.e., a safety net

for our trades. Even so, we will occasionally

encounter a stock (e.g., NUS) that experiences an overnight

big loss that then has to be managed through a repair strategy

that I won't describe here.

Hitwebcounter.com

Richard Miller, Ph.D. - Statistics Professional, is the

president of

TripleScreenMethod.com and

PensacolaProcessOptimizaton.com.

Copyright 2006

TripleScreenMethod.com

It should not be assumed that the methods, techniques, or indicators presented

in these pages will be profitable or that they will not result in losses. Past

results are not necessarily indicative of future results. Examples presented

on these pages are for educational purposes only. These setups are not

solicitations of any order to buy or sell. The author assumes no

responsibility for your trading results. There is a high degree of risk in

trading. I am not recommending that you purchase or short stocks or options

using the techniques and methods presented in this report. Trading should be

based on your personal understanding of market conditions, price patterns, and

risk. I present here information to contribute to your understanding a

technique that has worked well for me.